tax avoidance vs tax evasion uk

They are both forms of tax noncompliance. Avoid giving a direct answer to a question 3.

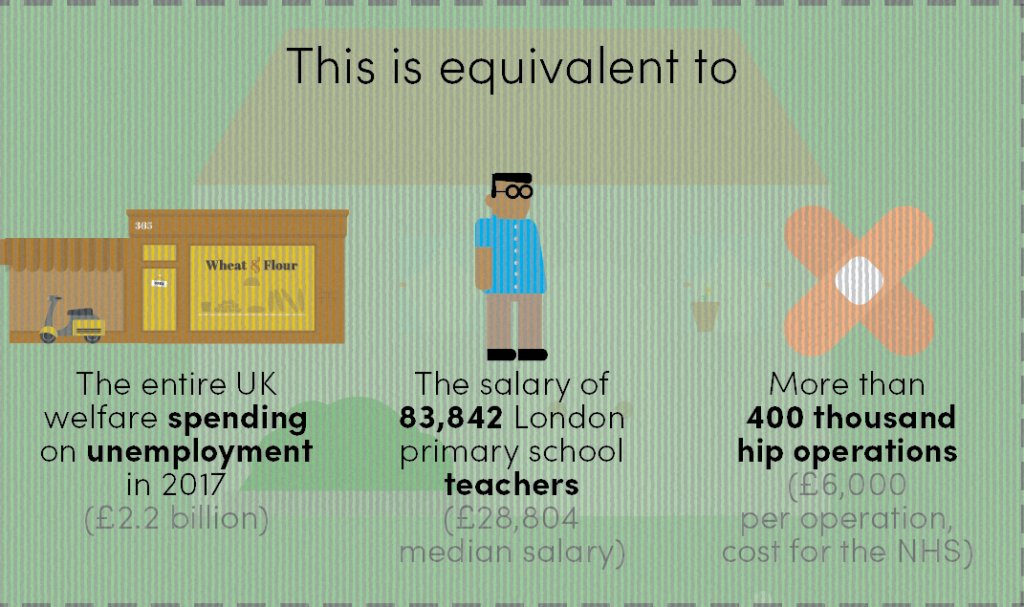

James Melville Pa Twitter We Lose 120 Billion In Tax Avoidance And Tax Evasion That S Enough To Give The Nhs 2 Billion A Week Put That On The Side Of A Bus

Well one massive difference is that tax evasion is illegal while tax avoidance is legal well to a certain extent anyway.

. If you do decide to listen you need to be very wary because TAX AVOIDANCE is legal but TAX EVASION is not. Avoiding Value Added-Tax VAT. Tax evasion means concealing income or information from tax authorities and its illegal.

HMRC has confirmed that it has generated billions in additional tax revenue in recent years. Tax evasion is when you use illegal practices to avoid paying tax. Putting shares in your wifes name.

The perpetrator can be convicted for six months in jail fined up to 5000. Tax avoidance involves legal means to reduce your tax bill. Tax avoidance means legally reducing your taxable income.

Tax evasion means concealing income or information from the HMRC and its illegal. In its most simplistic form there are plenty of people whose financial actions may be labelled as tax avoidance. HM Revenue and Customs said the.

By contrast tax avoidance is compliant with the law though aggressive or abusive avoidance as opposed to simple tax. It is sometimes difficult to appreciate the difference between the two but in basic terms tax evasion is deliberately escaping from paying tax that should be paid whereas tax avoidance is the exploitation of rules in order to reduce the tax that would otherwise be paid. Tax avoidance means exploiting the system to find ways to reduce how much tax you owe.

The most common example of Tax Evasion amongst small businesses is making. Tax evasion involves illegal means to reduce your tax bill. This activity is where information is omitted concealed or misrepresented to.

Tax planning either reduces it or does not increase your tax risk. Such tax avoidance is thought by some to be unacceptable as flouting the spirit of the law while following the letter albeit not criminal in the way that evasion is. Businesses get into trouble with the IRS when they intentionally evade taxes.

Tax Evasion vs Tax Avoidance. Assuming you owe tax you cant legally escape paying it. Its not always easy to see where one ends and the other begins.

Well the most commonly used definition is that tax avoidance is legal while evasion is not. Magistrates court cases can sentence up to six months in jail or a maximum fine of 20 000. The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts.

The maximum penalty for evading income tax is seven years of prison time or an unlimited fine. The UK authorities use the term tax mitigation to refer to acceptable tax planning minimising tax liabilities in ways expressly endorsed by Parliament. Where tax avoidance is not necessarily illegal tax evasion always is.

Because there is a difference between tax evasion and tax evasion. Common tax avoidance measures. It is sometimes difficult to appreciate the difference between the two but in basic terms tax evasion is deliberately escaping from paying tax that should be paid whereas tax avoidance is the exploitation of rules in order to reduce the.

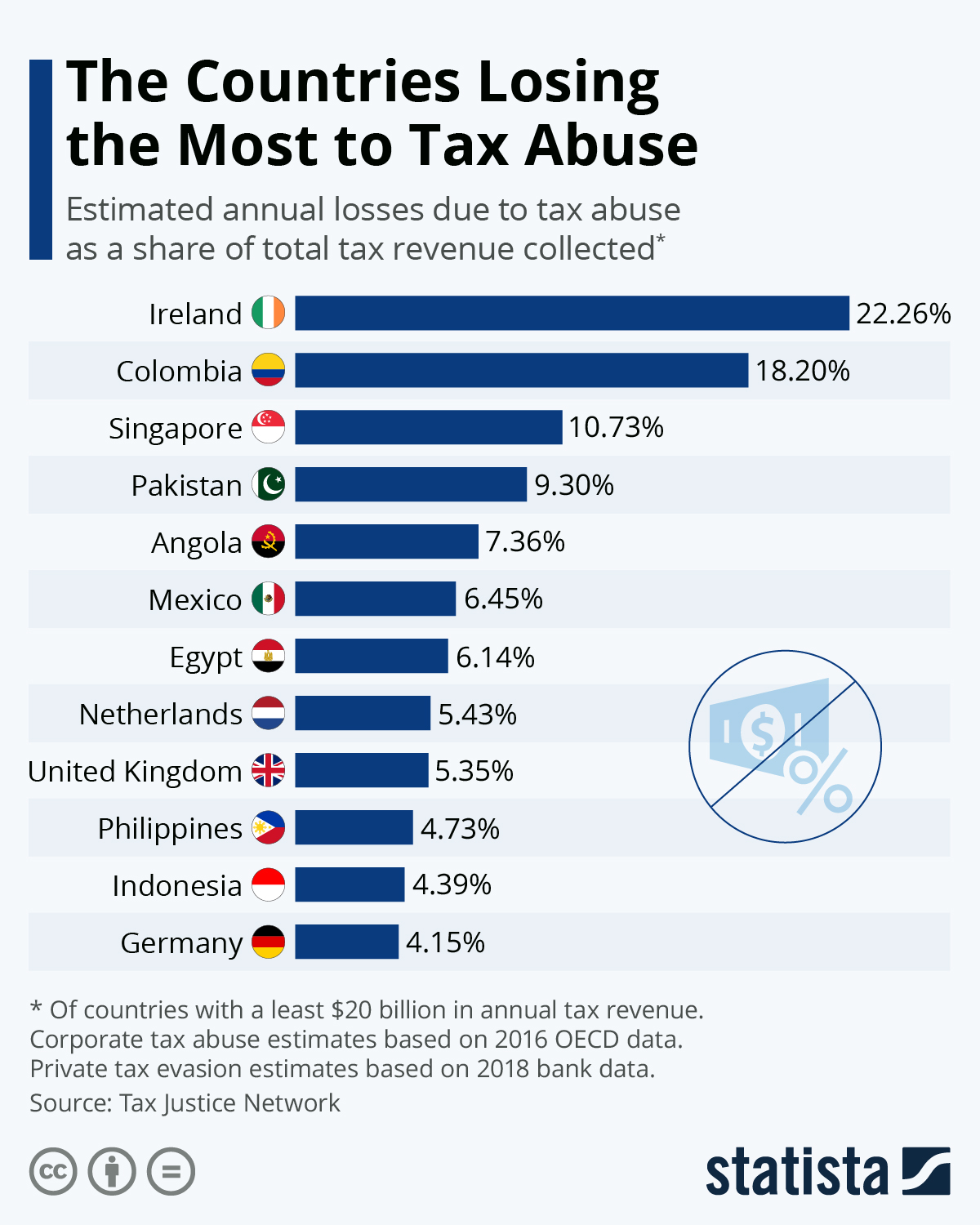

The amount of tax lost in Britain through non-payment avoidance and fraud has increased to 35bn according to official figures. One is illegal the other legal though arguably immoral on a larger scale. This could include not reporting all of your income not filing a tax return hiding taxable.

HMRC defines Tax Evasion as Concealing of taxable income or the use of benefits to avoid the tax payment Tax evaders do not disclose their taxable assets fake off-shore accounts hide the details of their income and conceal the financial reporting from HMRC. Effective tax planning will mean more money in your pocket either for investing or for spending. But the major difference between them is the fact that tax avoidance although morally dubious is legal while tax evasion is illegal.

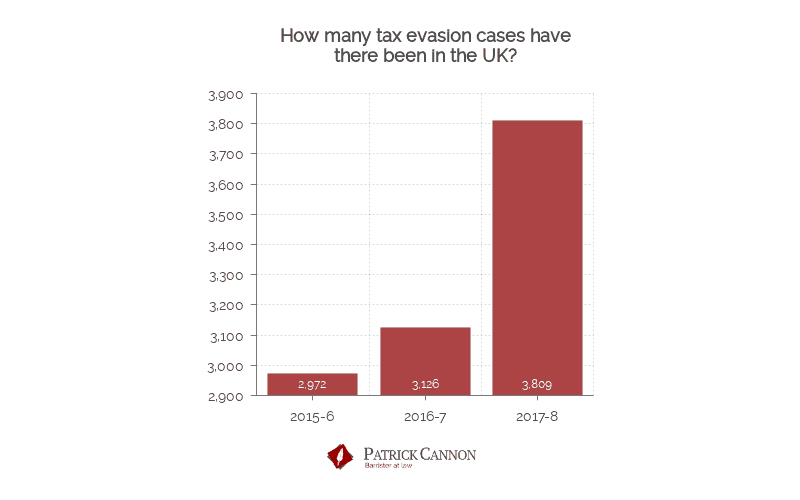

To many people tax avoidance simply means paying as little tax as possible while remaining on the right side of the law. However in some sophisticated cases the Taxman has been trying to blur the boundaries and claim some forms of tax avoidance are illegal. This comes after a push to tackle tax avoi.

Tax avoidance and tax evasion. Tax avoidance is to be distinguished from tax evasion where someone acts against the law. So there really isnt a huge difference in definitions apart from the very last point but its the idea of escape thats crucial.

In recent years tax avoidance has been the subject of considerable public concern although there is no statutory definition of what tax avoidance consists of. It often involves contrived artificial. Tax avoidance involves bending the rules of the tax system to try to gain a tax advantage that Parliament never intended.

If you do decide to listen you need to be very wary because TAX AVOIDANCE is legal but TAX EVASION is not. If your wife pays a lower income tax bracket the family will pay fewer capital gains tax than if you are eligible for paying. The difference between tax planning and tax avoidance is that tax avoidance always increases your tax risk.

Tax avoidance means exploiting legal loopholes to avoid tax. Avoidance measures are very common and members of the public are often encouraged to use them by the government. In very simple terms tax avoidance is legal but tax evasion is illegal and you risk prosecution for breaking the law.

Over the last five years HMRC estimate that proportion of tax lost through tax evasion has stayed roughly the same whilst the proportion lost through tax avoidance appears to be falling. HMRC takes a very dim view of both tax avoidance and tax evasion but while one isnt illegal the other most certainly is. Tax evasion is the deliberate non-payment of taxes that is illegal.

Escape paying tax duty. Tax Evasion It has also been interpreted to mean an illegal practice where a person organisation or corporation deliberately evades paying their authentic tax liability. What tax avoidance is.

Examples of Tax Avoidance. A perfectly legal way to avoid paying taxes in the UK could include. Basically tax avoidance is legal while tax evasion is not.

Tax evasion means illegally hiding activities from HMRC to avoid tax. If youve gone a step further and are deemed to be engaging in aggressive tax avoidance that HMRC doesnt agree with you could be investigated and potentially pay the tax back but it is a murky area at times.

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

Tax Avoidance Costs The U S Nearly 200 Billion Every Year Infographic

Pdf Tax Evasion Tax Avoidance And Tax Expenditures In Developing Countries A Review Of The Literature Semantic Scholar

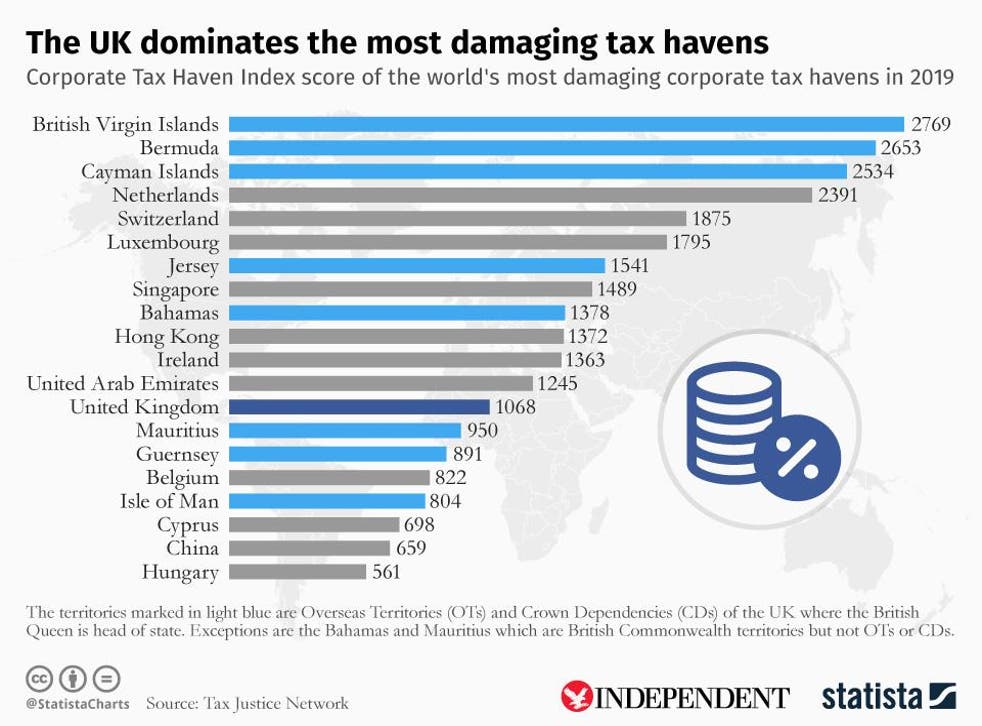

Uk Second Best At Tax Avoidance

Tax Avoidance What Are The Rules Bbc News

Tax Avoidance Is Not Tax Evasion But Try Telling Politicians Private Banking Asset Protection And Financial Freedom

Tax Avoidance Vs Tax Evasion What S The Difference

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Uk By Far The Biggest Enabler Of Global Corporate Tax Dodging Groundbreaking Research Finds The Independent The Independent

How Much Does Tax Avoidance Cost

Tax Evasion Vs Tax Avoidance Know The Difference Ico Services

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Evasion Statistics 2020 Uk Tax Evasion Facts Patrick Cannon

Benefits Fraud Vs Tax Evasion Cost To The British Taxpayer R Labouruk

Tax Avoidance Vs Tax Evasion Infographic Fincor

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

Differences Between Tax Evasion Tax Avoidance And Tax Planning